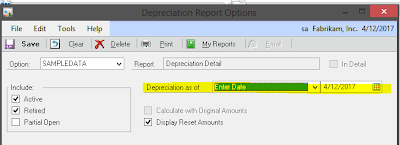

GP 2013 adds historical fixed asset reporting. I confess that when I heard this was coming I worried that we would get one report. Well, the GP team went way beyond that. Just about every fixed asset report now offers a 'Depreciation as of' field to make it easy to run historical fixed asset reports

You, Me and Dynamics GP

You, Me and Dynamics GP

The premier information site for Microsoft Dynamics GP

Showing posts with label Fixed Assets. Show all posts

Showing posts with label Fixed Assets. Show all posts

18 February 2013

21 January 2013

Weekly Dynamic: GP 2013 Historical Fixed Asset Reporting

Historical fixed asset reporting is now integrated into Dynamic GP 2013. Almost all of the reports now have a date associated with them. For example, the often used Depreciation Ledger by Class now includes a "Depreciation as of" selection allow you show the depreciation as of a particular date, not just the last run date.

10 December 2012

Mohammad R. Daoud: Printing Barcodes for Fixed Assets

Mohammad Daoud provides an option for Printing Barcodes for Fixed Assets

03 December 2012

Microsoft Dynamics GP Year End Release 2012: Fixed Assets Year End Close

The GP Support Team continues their look at year end with: Microsoft Dynamics GP Year End Release 2012: Fixed Assets Year End Close

07 November 2012

Fixed Asset ID Missing in Dynamics GP 2010

Sheldon shows off a solution for Fixed Asset ID Missing in Dynamics GP 2010

10 October 2012

Guidelines for fiscal period/year changes with Fixed Assets in Microsoft Dynamics GP 10 and 2010.

The GP Support and Services blog provides Guidelines for fiscal period/year changes with Fixed Assets in Microsoft Dynamics GP 10 and 2010.

09 October 2012

Dynamics GP 2013 Fixed Assets enhancements | Dynamics University

Gina Hoener likes some of the new Dynamics GP 2013 Fixed Assets enhancements. I do too.

13 September 2012

Weekly Review: Undo Depreciation

It’s not unheard of for someone to make a mistake with depreciation. Maybe an

asset was put into service early for example. Well if you need to undo

depreciation for a single asset in Dynamics GP it’s very easy. Simply go to the

Routine for Depreciate One Asset, select the asset to undo depreciation for and

set a new depreciation date. So if an asset was depreciated through 2/28/11 and

you need to put it back to 1/31/11 set the depreciation date to 1/31/11. GP will

warn you that the depreciation date is earlier than the depreciated through date

and this will back out depreciation in GP. Once depreciation is processed the

subledger is updated and a reverse GL transaction is created when the GL

Transaction routine is run.

This works great for a single asset and is really easy to do. So what happens if you accidently mess up a complete depreciation run? Microsoft support has a script that can undo a depreciation posting. I’m working on getting permission to post the script. Until that happens you can contact Microsoft support and they’ll send you the script.

This works great for a single asset and is really easy to do. So what happens if you accidently mess up a complete depreciation run? Microsoft support has a script that can undo a depreciation posting. I’m working on getting permission to post the script. Until that happens you can contact Microsoft support and they’ll send you the script.

Originally Posted by Mark Polino

at 2/07/2011

09:00:00 AM

06 September 2012

Feature of the Day: Fixed Assets to General Ledger - Inside Microsoft Dynamics GP - Site Home - MSDN Blogs

I told you that Fixed Assets was getting some nice features in 2013 including Fixed Assets to General Ledger Batches

30 August 2012

Feature of the Day: Fixed Asset Calendars - Inside Microsoft Dynamics GP - Site Home - MSDN Blogs

I like the idea of this Feature of the Day: Fixed Asset Calendars. I understand the concept of why you would want different fixed asset calendars for different books. Frankly though, I've screwed up fixed assets with a bad calendar and it was not pretty to fix. Multiple calendars won't help that.

Feature fo the Day: Mass Depreciation - Inside Microsoft Dynamics GP - Site Home - MSDN Blogs

I'm doing a happy dance for this Feature fo the Day: Mass Depreciation backout! This shouldn't be needed very often but when it's needed it's really needed.

27 August 2012

Feature of the Day: Intercompany Asset Transfer - Inside Microsoft Dynamics GP - Site Home - MSDN Blogs

I've mentioned that Fixed Assets is getting an overhaul in GP 2013 and here is one of the new features: Intercompany Asset Transfer

23 August 2012

Weekly ReviewFixed Asset Impairment

There is no Fixed Asset Impairment feature

in Dynamics GP per se but that doesn't mean that it can't be done. The simplest

way to accomplish a full or partial Fixed Asset impairment is do a full or

partial retirement of the asset in GP and create a retirement code to identify

impairments. Since GP supports partial retirement by cost or % this will work

for assets that contain multiple quantities in GP.

For example, a $100,000 assets is impaired and is now only worth $60,000. The company can partially retire 40% of the asset (or specifically retire $40,000) and take a loss.

The nice thing about this is that it's easy to un-retire an asset. While Generally Accepted Accounting Principles (GAAP) won't allow you to un-impair an asset, International Financial Reporting Standards (IFRS) will. As the world moves toward IFRS, the ability to un-retire an asset and recapture the impairment becomes more important. It's also nice if you goof when retiring the asset.

For reporting purposes, using an impairment retirement code makes it easy to separate out impairment transactions from true retirements.

For example, a $100,000 assets is impaired and is now only worth $60,000. The company can partially retire 40% of the asset (or specifically retire $40,000) and take a loss.

The nice thing about this is that it's easy to un-retire an asset. While Generally Accepted Accounting Principles (GAAP) won't allow you to un-impair an asset, International Financial Reporting Standards (IFRS) will. As the world moves toward IFRS, the ability to un-retire an asset and recapture the impairment becomes more important. It's also nice if you goof when retiring the asset.

For reporting purposes, using an impairment retirement code makes it easy to separate out impairment transactions from true retirements.

Originally Posted by Mark Polino

at 1/10/2011

09:00:00 AM

06 August 2012

Feature of the Day: Fixed Assets - Inside Microsoft Dynamics GP - Site Home - MSDN Blogs

You can put this down as my favorite Feature of the Day: Historical Fixed Asset Reporting

09 July 2012

Weekly Dynamic: Fixed Asset GL Account Transfer

A lot people don't use Fixed Asset transfers because they think in terms of the physical movement of assets but transfers can be used for more than that. For example, if an asset has been going to a wrong account or if you decide to reorganize fixed assets and change accounts a fixed asset transfer can be used to move the GL accounts.

To transfer GL accounts for Fixed Assets in GP open the Financial Area Page. Under Fixed Assets pick Transfer. Select an asset and transfer date. Click the blue arrow next to G/L Accounts. Change the accounts that need adjustment and click transfer.

To transfer GL accounts for Fixed Assets in GP open the Financial Area Page. Under Fixed Assets pick Transfer. Select an asset and transfer date. Click the blue arrow next to G/L Accounts. Change the accounts that need adjustment and click transfer.

07 May 2012

Weekly Dynamic: Fixed Asset Modifier

Paraphrasing a well know commercial “Fixed Assets are messy, clean ‘em up”

Over time fixed asset numbering can get kind of messy, especially if you’re trying to keep some kind of logic to it. May you want your FA numbers to all be 5 digits and someone keys the asset with 4 digits. Well the Fixed Asset Modifier, part of the now free Professional Service Tools, will let you rename an asset with minimal fuss.

It’s about a straightforward as you can get, enter or lookup the old number, key in the new number. The system retains the suffix which could be a challenge if you’re trying to cluster multiple assets based on an asset ID but it’s better than nothing.

Over time fixed asset numbering can get kind of messy, especially if you’re trying to keep some kind of logic to it. May you want your FA numbers to all be 5 digits and someone keys the asset with 4 digits. Well the Fixed Asset Modifier, part of the now free Professional Service Tools, will let you rename an asset with minimal fuss.

It’s about a straightforward as you can get, enter or lookup the old number, key in the new number. The system retains the suffix which could be a challenge if you’re trying to cluster multiple assets based on an asset ID but it’s better than nothing.

17 April 2012

Lean Accounting: Fixed Assets

Steve Bragg is back with another episode of the Accounting Best Practices podcast. Steve wraps up his look at lean accounting with an unlikely look at Lean Fixed Assets in episode 139.

16 February 2012

How to update Fixed Asset Labels using Microsoft SQL Server Management Studio - Dynamics GP Support and Services Blog

From Angel Melhus come information on How to update Fixed Asset Labels using Microsoft SQL Server Management Studio

15 February 2012

08 February 2012

Fixed Assets depreciation overstated or negative Net Book Value - Dynamics GP Support and Services Blog

Ken Hubbard wins a prize for best Avatar ![]() and for addressing Fixed Assets depreciation overstated or negative Net Book Value

and for addressing Fixed Assets depreciation overstated or negative Net Book Value

Subscribe to:

Posts (Atom)