If all the other tax options in Microsoft Dynamics GP aren't enough for you there is another option that is not enabled by default. Users can calculate tax directly in a GL transaction.

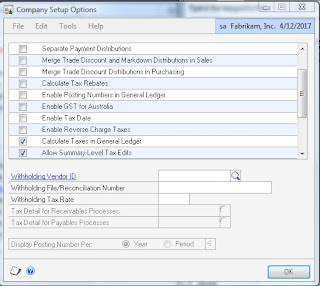

To use this feature, we first have to turn it on. On the Administration navigation page, under Setup, pick Company, Company and press the options button. (Alternatively, Dynamics GP Menu->Tools->Setup->Company->Company, Options). Check the box marked "Calculate Taxes in General Ledger" then Ok your way out of there.

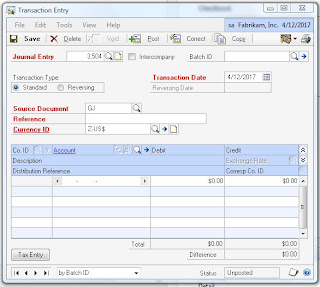

Now select Financial navigation page and pick General under Transactions, Financial. The GL entry window now has a new button marked "Tax Entry" in the lower left. Clicking this opens up the Tax Entry Window.

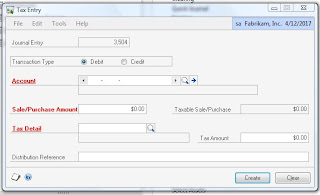

The tax entry window is for the whole transaction line, not just the tax. Enter a transaction line account and amount. Select the tax detail. GP will calculate the tax amount. Optionally you can add a distribution reference. Clicking process creates 2 line items in the GL, a transaction line and a corresponding tax line. You still have to add the offset line to make the transaction balance in the GL.

The cool part about this is that you can add tax to just one line of a journal entry and let GP do all the calculations for you.

Originally Posted by Mark at 8/03/2009 09:00:00 AM

You, Me and Dynamics GP

You, Me and Dynamics GP